Doing All Needed To Excell

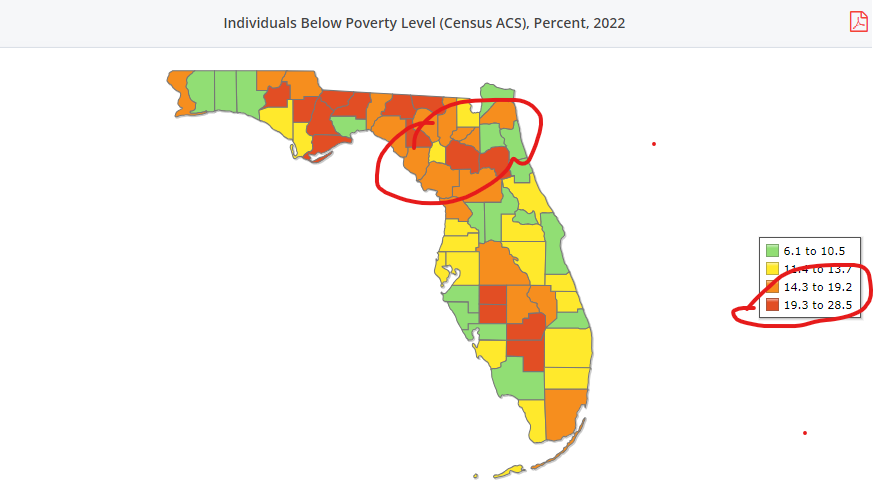

Alachua County Ranks Top 3 In The State Of Florida For Individuals Living Below The Poverty Rate Per Population.

The Dante Anderson Foundation Inc. is committed to empowering individuals with the knowledge necessary to transform their financial understanding and, consequently, their financial situation. Through our mentorship and programs, we strive to make the American dream more attainable for all individuals who are willing to apply themselves.

Our Mission

The Dante Anderson Foundation Inc. envisions a future where minority communities and families are equipped with the knowledge, resources, and skills necessary to break the cycle of financial disadvantage and create enduring generational wealth for their loved ones. We are dedicated to fostering economic empowerment, education, and opportunity within these communities, ensuring that every individual has the means to build a legacy of prosperity, security, and achievement for generations to come.

Our Vision

The Dante Anderson Foundation Inc. is passionately committed to empowering minority communities and families by delivering accessible financial education, mentorship, and vital resources. Our unwavering mission is to catalyze economic empowerment and cultivate pathways to lasting generational wealth, equipping underserved communities with the essential tools and unwavering support necessary to attain unshakable financial security and independence.

Your Impact Begins Today!!

Our Workshops Focuses On Three Main Aspects Of Financial Literacy

That Influence The Wealth Gap Are.....

Income Generations

This involves understanding how to earn money through various means such as employment, investments, entrepreneurship, and other income streams. Financial literacy in this aspect includes knowledge of different income opportunities, salary negotiations, and effective ways to maximize earnings

Financial Management

This aspect covers budgeting, saving, debt management, and spending wisely. It involves creating and maintaining a budget, understanding how to save effectively, managing credit and debt, and making informed decisions about spending to avoid financial pitfalls.

Investment and Wealth Building

This focuses on growing wealth through investments in stocks, bonds, real estate, and other financial instruments. Financial literacy here includes understanding risk management, diversification, compounding interest, and long-term financial planning. Knowledge in this area helps individuals make informed investment decisions that can significantly impact their financial stability and growth. Understanding and improving these aspects can help bridge the wealth gap by providing individuals with the skills and knowledge to manage their finances better and build wealth over time..

Understanding And Improving These Aspects Can Help Bridge The Wealth Gap By Providing Individuals With The Skills And Knowledge To Manage Their Finances Better And Build Wealth Over Time.

Cultivating an environment of opportunity

Our Mentorship Programs Can Foster Financial Literacy Through Three Main Aspects

Personalized Guidance

Mentors provide one-on-one support tailored to the mentee’s individual financial situation and goals. This personalized approach helps mentees understand complex financial concepts and make informed decisions.

Practical Experience

Through hands-on activities, such as budgeting exercises, investment simulations, and real-world financial planning, mentees can gain practical experience and confidence in managing their finances.

Support & Accountability

Continuous mentorship ensures that mentees stay on track with their financial goals, receive regular feedback, and have a support system to navigate challenges and celebrate successes.

Our Sponsors

Contact Us

Address: 1032 NW 23rd ave Gainesville Fl 32609

Phone: 866-312-3512

Email : Thdanteproject22@gmail.com

Links :

- Home

- About us

- Programs

- Donate

- Get Involved

- Contact Us